Sea Piracy and Armed Robbery in the Gulf of Guinea and Its Effect on Shipping Cost and Nigeria’s Economic Growth

Oceanography & Fisheries Open Access Journal Juniper publishers

Abstract

Purpose: The Due to the increasing rate of economic damages of insecurity to the Nigerian maritime industry with cases of loss of revenue to the federal government occasioned by; high freight charges for Nigeria bound cargoes, high insurance premium chargeable on both ships and cargoes, coming to Nigerian and total boy-cut of the Nigerian ports by most shipping lines. The researcher has been led to carry out research on sea piracy and armed robbery in the Gulf of Guinea and its effect on shipping cost and Nigeria’s economic growth. This research was set out to realize some specific objectives, while research hypotheses were formulated in this regard to address the objectives of this study.

Design/methodology/Approach: The research adopted ex-post facto design. Data were sourced through secondary means from Nigeria Maritime Administration and Safety Agency’s (NIMASA) statistical bulletin, EViews version 12 statistical, forecasting, and modeling was used and simple regression analysis was used to model the relationship between the dependent and independent variables in the research hypothesis which was tested at 5% level of significance.

Findings: The result of the analyses indicated that the model shows that piracy inversely relates with economic growth of Nigeria. It also found out that there is significant relationship between piracy and armed robbery and the cost of shipping due to premium paid because of piracy activities.

Originality/value: This research has X-rayed that Nigeria’s maritime sector is bedeviled by various crimes related activities that affect revenue generation and contribution from this sector. Effective ways of curbing this menace have been highlighted in this work. This paper will provide NIMASA reasonable information with the activities of pirates in the Nigerian waters and how to curb their excesses and may act as a working document.

Keywords: Sea piracy; Armed robbery; Shipping cost; Economic growth

Introduction

Background Information

Shipping has for a long time been recognized as one of the strong catalysts for socio-economic development. This means of transport mode is one of the cheapest and efficient means of transportation over a long distance. However, shipping operations have suffered a lot of challenges in insecurity along its maritime domain and corridors. Armed attacks against ships in the oil-rich Gulf of Guinea surged in 2018, making these waters off west and central Africa the world’s most dangerous maritime route. The United States (U.S) office of Naval Intelligence (ONI) documented 146 incidents of piracy and armed robbery in the Gulf of Guinea in 2018, a 24% increase over 2017 records. The increase in these attacks confirms that the gulf of Guinea’s status as the main locus for maritime insecurity in Africa, which had long been associated with the Horn of Africa, particularly Somalia. Rising piracy and armed robbery in the Gulf of Guinea reflects the region’s growing prominence in global maritime trade, as well as capacity and coordination gaps among the region’s navies [1].

The economic effects of piracy extended beyond littoral states to land-locked countries, which depend on these ports for their imports and exports. According to the United Nations Assessment mission on piracy in the Gulf of Guinea, the annual loss to the economy of west African sub region of piracy is estimated at $2billion [2]. In Nigeria, Piracy threatens the vital fishing industry and regional trade, and long with bunkering, reduces oil revenue and therefore potential financial support for the Delta region [1]. This study will analyse the effect of sea piracy and armed robbery on cost of shipping and Nigeria economic growth and assess the relationship between piracy and the Gross Domestic Products from maritime generated activities. The overall objective of this report is to provide a clear understanding of the relationship between the effect of sea piracy and armed robbery and the nation economy.

Problem Identification

Nigeria is a major force in international trade, with 70 percent of goods coming to west and central Africa destined to Nigeria, out of which 80 percent of the traded goods are transported by sea (UNCTAD, 2009). Therefore, the study of Maritime Domain Safety is crucial to the sub-region. Nigeria remains the hotspot of piracy in Africa. In 2016, the International Chambers of Commerce (ICC) recorded an increase of 157% in Nigeria alone (14 in 2015 compared to 36 piracy attacks in 2016), Abhyankar [3]. Nigeria account for over 60% of total seaborne traffic for the 16 nations in the West African sub-region [4], as warning to mariners in and near Nigeria waters become more common, increased shipping cost for Nigeria and Gulf of Guinea destinations are likely as shippers begin to pack higher insurance premiums into their pricing.

Because increase shipping costs are typically passed onto consumers, they are likely to be inflationary pressures for vital goods and services throughout the region if Nigeria piracy persists. Despite the attacks on Western oil interests, piracy in Nigeria receives less attention than in other regions of the world. Without external pressure and with a federal government either unwilling or unable to act, piracy is likely to increase as a result, conditions in Delta region will continue to deteriorate for many of its inhabitants, providing more incentive for individuals with limited economic opportunities to turn to maritime crime. Piracy and armed robbery have been seen as having serous effect on the economic activities of Nigeria especially high level of premium paid and cost of movement of goods and services not considering the loss of lives and properties within the regions in the Gulf of Guinea. Against the backdrop of this incidence, this work is on the sea piracy and armed robbery in the Gulf of Guinea and its effect on cost of shipping and Nigeria’s economic growth.

Objectives

The aim of the study is sea piracy and armed robbery in the Gulf of Guinea and its effect on Nigeria’s economy.

The specific objectives include:

• To analyses the extent cost of ransom on Premium paid affects shipping cost.

• To investigate the relationship between sea piracy and Nigeria’s economic growth.

Research Hypotheses

HO1: There is no significant relationship between the cost of ransom and Premium paid by shipping companies.

HO2: There is no significant relationship between sea piracy and Nigeria’s economic growth?

Justification of Study

The information from the study would assist the Federal government of Nigeria, Ministries of Petroleum and Transport (Maritime), International Oil and Shipping Companies on how to curb piracy attack in and around Nigeria waterway. It would assist Production and Marine Companies on how to operate and protect their business assets from eminent attack by pirates. Assist regional body like ECOWAS and East African Community (EAC) to adopt similar measures used in curbing piracies and criminality in the Gulf of Aden or Arabian Peninsula.

Scope of the study

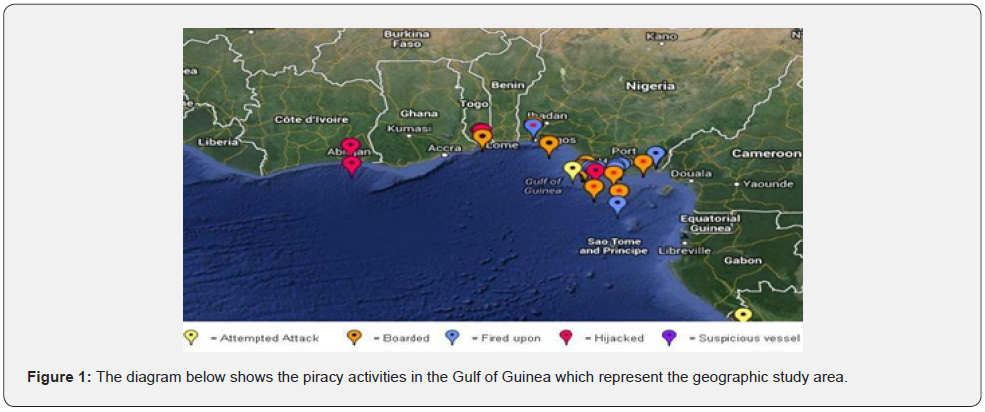

From the diagram above, the light-yellow area of the Gulf of Guinea of the map shows the of the activities of pirates that is majorly under attempted attack within the period of this investigation (research work) (Figure 1). Also, the deep yellow colour area of the map shows the of the activities of pirates that is majorly boarded to commit crimes and robbery attack within the period of this investigation (research work). While the blue area of the Gulf of Guinea of the Gulf of Guinea map shows the activities of pirates that is majorly under firing on vessels by the pirates and armed robbers attack within the period of this investigation (research work). The activities are majorly in the area linking Ibadan, port Harcourt and within the surroundings. However, the pink colour area of the guinea map shows the activities of pirates that is majorly under hijacking of vessels by the pirates and armed robbers attack within the period of this investigation (research work). The activities are majorly in the area linking port Harcourt and with the Gulf of Guinea.

Related Literature Review

Economic impacts of piracy on the Commercial Shipping Industry

Most of all international trade is transported by sea, both in terms of Value and weight [5], while millions of people make use of maritime transport for travel and recreation [6]. The presence of pirates in several regions around the world affects maritime transport. The economic impacts of sea piracy on commercial shipping are derived from both the threat of piracy and the consequences of actual attacks. The threat of attacks has prompted changes in vessel management, including routing, speed, and scheduling adjustments; provoked the application of various security measures, including the use of armed guards and the installation of citadels and razor wire, among other equipment; and raised the cost of insurance, including both ‘war risk’ and ‘kidnap and ransom’ insurance premiums [7]. The impact of actual attacks has resulted in the payment of ransoms for kidnapping and hijackings not covered by insurance; and incurred losses due to damage to or theft of the crew’s belongings, cargo, and the vessel [8].

The economic impact on regional nations

Countries bordering with Gulf of Guinea, suffers the greatest regional economic impact of piracy. Between 2006-2018 piracy negatively impacted maritime trade, tourism, and stability in the Region, as discussed below. The international community has increasingly taken note of piracy in the Gulf of Guinea due to the growing threat this activity represents, not only to the lives of sailors, but to both the regional and global economy. Since they derive their profits from the sale of oil and other goods rather than the ransoming of hostages, pirates in the Gulf of Guinea have proven to be significantly more violent than their Somali counterparts. Vessels are frequently sprayed with automatic weapons fire, and the murder of crew members is not uncommon. Recent events indicate that these pirates are even willing to attack vessels with security personnel aboard, evidenced by the recent killing of two Nigerian sailors guarding an oil barge. Given that pirates are now adopting heavier weapons and more sophisticated tactics, this violence is only likely to increase [9].

Beyond the bloodshed, the expansion of piracy in the Gulf of Guinea poses a dire threat to local economies, potentially undermining what little stability currently exists in the region. Oil revenue, which many countries in the region rely upon, is seriously threatened by pirate activity; 7 percent of Nigeria’s oil wealth is believed lost due to such criminality. Additionally, instability in the Gulf has sharply decreased revenue collected from trade; Benin, whose economy depends on taxing ships entering the port of Cotonou, has experienced a 70 percent decline in shipping activity due to piracy. Furthermore, as piracy drives up insurance premiums for international shipping companies, the price of imported goods in the region could spike, further imperilling local economies. If these local economies falter, development and stability in the region could quickly deteriorate [10].

However, the effects of piracy in the Gulf could well extend far beyond Africa, with potential ramifications for the larger global economy and the United States in particular. The estimated 3 million barrels of oil produced daily by the nations around the Gulf ultimately feed the North American and European markets. Nigeria alone is the fifth-largest supplier of oil to the United States and by 2015 could account for a quarter of U.S. oil consumption. However, given the rate at which attacks on oil tankers are increasing, the ability of these nations to reliably provide oil to the international market could be in question. Early 2012 saw a doubling in the number of attacks on oil tankers, with as many as eight hijackings in a month. If this dramatic trend continues, the flow of oil from the Gulf of Guinea to the United States and the West could slow considerably.

modelling

The most direct and obvious consequence of piracy is economic. Nigeria loses $25.5 billion annually to piracy in its coastal waters. Much of this loss revolves around the theft of crude oil now put at 300, 000 barrels per day or 12 percent of daily production. Between 2003 and 2008, illegal maritime activities cost Nigeria $92 billion. The threat of piracy is of grave concern to ship owners and to those who hire ships. Ship owners sustain heavy losses on hijacked ships which are demobilized for a long time. This is compounded by the threat to the crew. These factors are increasingly compelling mariners to avoid routes that pass through Nigerian waters, while vessels find it difficult to crew ships [11].

Piracy also exerts an indirect impact on the Nigerian economy. It has disrupted Nigeria’s commercial fishing industry. Although the domestic fish market accounts for just 20 percent of all the fish consumed in Nigeria, that percentage has steadily decreased over the past five years because of the rise in piracy, according to a 2007 study by the United States Department of Agriculture. This has resulted in a sharp decline in fish consumption, now put at 7.5 kg annually, well below the 13 kg recommended by the FAO. Nigeria now imports between 700,000 and 900,000 metric tons of fish at the cost of over N50 billion annually to make up for this shortfall – an enormous outlay that is perforating the nation’s finances. Thus, we see that the impact of piracy extends well beyond the province of maritime security to economics, in terms of lost jobs in the commercial fisheries sector, to even nutrition by reason of its impact on the local availability of fish proteins for our children.

The direct economic cost of piracy.

The main direct cost of piracy, including the cost of ransoms, piracy insurance premiums deferent equipment, re-routing vessels away from piracy risk zone, naval deployments in piracy hot zones, piracy prosecutions, and organization budgets dedicated to reducing piracy.

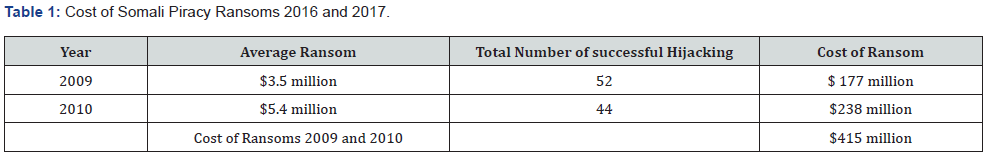

The Cost of Ransoms

One of the most spectacular increases in the cost of piracy in recent years has been the increasing price of ransoms paid to release hijacked ship. Ransoms are generally sought by Somali pirates. Pirates in the other regions have more often stolen the vessels or cargo, rather than ransoming the value of the seafarers’ lives and their ship. In November 2010, the highest ransom on record $ 9.5 million, was paid to Somali pirates to release the (Samho Dream) South Korean oil tanker [12]. Indeed 2010 set a remarkable record for the cost of ransoms, with the year kicking off to a $ 7 million ransoms paid in January to release the Greek super tanker (MV Moran Centaurs’), which had been carrying $162 million of crude oil from Saudi Arabia to the United States. The ransoms demonstrated the exponential increase in the price of ransoms in recent years. In 2005 ransoms averaged around $ 150.000 (Payne,2010). By 2009, the average ransom was around $ 3.4 million. In 2010, ransoms are predicted to average around $5.4 million [13].

Problematically, increasing ransom payments appear to be lightening negotiations and therefore the duration seafarers are held hostage; the average length of negotiations has more than doubled over the past year as pirates seek and receive, larger ransom payments. Ships were held for an average of 106 days between April and June of 2010, up from just 55 days in 2009, and the last four ship release in November 2010 were held for an average of 150 days (NPR,2010). Seafarers now face the likelihood of three tour month captivity. The total cost of ransom is estimated to be around double the value actually paid to pirates. The total cost is duplicated by several factors such as the of cost of negotiations, psychological trauma counselling, repair to ship damage caused while it is held captive, and the physical delivery of the ransom money, often done by helicopter or private plane (BBC News, February 5, 2009). Finally, large costs result from ship being held and out of service for instance, it cost around $3milllion for cargo ship to be held for two months at a charter hire rate of $50,000 per day (Kraska) (Table 1). By doubling the cost for the estimate cost of ransoms for 2016 and 2017 ($415 million) to incorporate excess cost such as negotiation and delivery fees, we approximate that over the past two years, around $830 million has been spent on ransoms.

Source: IMB, 2011

The Cost of Insurance

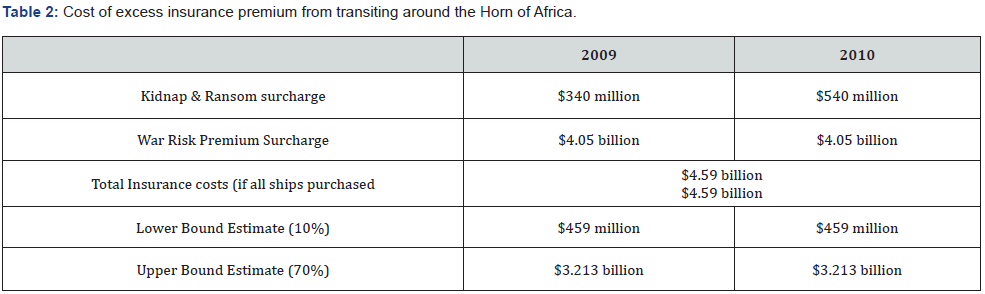

In reaction to the growing threat and cost of ransoms, the maritime insurance industry has responded by increasing its shipping rates and premiums, especially in designated high-risk piracy zones. Shipping insurance comes in four main types: war risk, kidnap and ransom, cargo, and hull insurance

• War Risk: War Risk insurance is an excess charge for a vessel transiting a war risk area. The Gulf of Aden was classified as a war risk area by Lloyd’s market Association (LMA) joint war committee in May 2008. Since this date, the cost of war risk premiums has increase 300-fold (insurance broker marsh McLennan, June 26, 2009), from $500 per ship, per voyage, to up to $150 per ship, per average, in 2010 (UNODC). Other regions affected by piracy have also been classified as war risk zones in the past, such as the Malacca strait between 2005 and 2006.

• Kidnap and Ransom (K&R); Generally, K&R insurance covers the crew against ransom demand, but not the vessel or cargo. However, some marine insurance policies have recently expanded to include both crew and property. Insurance giant Munich Re-estimates that K&R premium increased tenfold between 2008 and 2009 (GIRO, marine piracy 2010).

• Cargo: Cargo insurance covers goods transported by a vessel. The excess premium on cargo transiting piracy region is estimated to have increased by between $25 and $100 per container in the few years (Emmanuel, “Time to Join the Fight against Maritime Piracy, September 23, 2010).

• HULL: Hull insurance covers physical damage to the ship, including harm from heavy sea, collision, sinking, collapsing, grounding, fire, or piracy. It estimated that piracy has doubled the cost of hull insurance. In calculating the global cost of maritime piracy, we take the largest insurance premiums related to piracy (War risk and K&R) and multiply these rates by 90% of the total ship traffic transiting the high-risk region of the Gulf of Aden (around 30,000 ships). We deduct 10% of ship traffic under the assumption that this proportion of ships opts to re-route around the Cape of Good Hope and is therefore not liable for insurance premiums (Table 2).

Source: IMB 2011

In the war risk region, note that as piracy continues to increase across the globe, and insurance against piracy attacks becomes an increasingly lucrative business, we may witness premiums decrease as competitors move into the market. As one marine underwriter at Lloyd’s of London stated, “Traditional carriers have been cutting each other so much to get the premium in that the price has fallen off the end of a cliff.

The Cost of Re-Routing

For some vessels, especially low and slow-moving ships, which are at the greatest risk of piracy attack, avoiding risk zones altogether may be a safer or cheaper option. For example, some ships may opt to avoid the risk of transiting through the Gulf of Aden and Suez Canal, and instead take the longer voyage around the cape of good hope while robust data on the proportion of ship owners and masters who re-route their vessels via this longer route is not readily available, some companies have announced that they are diverting their fleet. For example, AP Moller Maersk, European largest ship owner, is diverting all 83 tankers, as are the Norwegian stole tanker fleet, Odell shipping group (with a fleet of 90 tankers), and frontline. We also know that Egypt’s Suez Canal revenue (fees collected from ships transiting the Suez Canal) has decreased by 20% in the past couple of years [12].

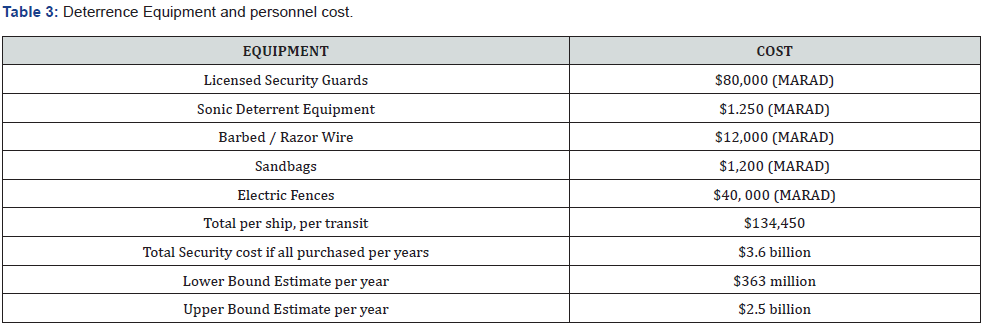

The cost of deterrent security equipment

Ship owners attempt to protect their property and crew from pirate attacks by preparing their ships with security equipment and/or personnel prior to transiting a high-risk zone. Robust data on the proportion of ships purchasing deterrence equipment, and the type of deterrence equipment, is not easily accessed. Nevertheless, average cost of deterrence equipment and personnel are listed in table – below. These rates reflect cost for equipment used to transit around the Horn of Africa. Since this is the area that the ship owners would likely be most interested in purchasing deterrent equipment. Just as for the cost of insurance premiums above the approximate a lower bound (10% of ships) and an upper bound (70% of ships). Estimate for the total cost of deterrence equipment to the shipping industry. We calculate that the total cost of deterrence equipment to the shipping industry is between $360 million and $2.5 billion per year (Table 3).

Measures to deal with maritime piracy

Regional Cooperation

The Djibouti Code of Conduct: In 2009 a high-level meeting of 17 countries from the Western Indian Ocean, Gulf of Aden and Red Sea areas met in Djibouti and adopted a “Code of conduct concerning the repression of piracy and armed robbery against ships in the Western Indian Ocean and the Gulf of Aden”. There are signatories to the code of conduct to undertake wideranging commitments to cooperate in seizing, investigating and prosecuting pirates in the region, and to review their relevant national laws. The code of conduct allows authorized officials to board the patrol ships or aircraft of another signatory. Nine countries have so far signed the code of conduct. These include Djibouti, Ethiopia, Kenya, Madagascar, the Maldives, the Seychelles, Somalia, Tanzania, and Yemen [14].

Source: MARAD, 2010

International Cooperation

United Nations Recognizing the seriousness of maritime piracy in the Gulf of Aden, the Secretary-General of the United Nations has called fora multifaceted approach to combating piracy “to ensure that the political process and the peacekeeping efforts of the African Union and the strengthening of institutions work in tandem”. The United Nations Security Council has been actively engaged in formulating adequate responses to the issue of piracy. Several UN Security Council resolutions have been adopted to address the delivery of humanitarian aid to Somalia and the protecting and escorting ships employed by the World Food Programme.

Role of the bank in combating piracy

The impact on sea borne trade and maritime economic opportunities pose serious challenges to Africa’s development agenda. The Bank can play an important part in combating piracy [15].

Improvements in port security

Michael Baker observes that shipping companies send smaller, older, and cheaper ships to Africa because the ports cannot handle modern fleets. As a result, shipping companies deploy their remaining smaller and slower ships for transport to and from Africa, increasing the number of easy targets for pirates and further impeding Africa’s ability to export products efficiently. The Bank can contribute by increasing resources to improve port infrastructure, Daniel [16].

Possible direct effects of modern maritime piracy

The possible direct effects include.

Delays caused by attempted attacks themselves due to escaping maneuvers.

• Damage to the ship or cargo incurred in the attack.

• Loss of safe and cash money.

• Loss of cargo.

• Loss of hire.

• Loss of operation during the attack and investigation procedures.

• Loss of the whole ship as a cause of hijacking.

• Kidnap and ransom money for ship and seafarers.

• Investigation costs.

• Costs of negotiating and delivering the money.

• Contractual penalties due to delayed or damaged delivery.

• Cargo fraud with phantom- or ghost-ships.

With daily vessel operating costs ranging from US $10,000 to US $50,000 or more, spending a week in a port while sometimes untrained or corrupted local police doing their investigation will usually cost a lot more in lost time than a small pirate attack itself. Munich Re Group [17].

Possible indirect effects of modern maritime piracy

• Security cost like: costs incurred in the fight against piracy; additional security measures, additional security costs, increase transport price, insurance costs [17].

• Insurance cost: Possible effects in respect to insurance costs are higher premium in piracy-prone areas, additional kidnap, and ransom insurance, change in trade routes [14].

Procedures of the IMO change continuously. The official warning today is to sail 250 nautical miles of the East coast of Africa. This will lead to non-optimal economic routes and a price increase of maritime transport [18].

• Effects of change in shipping routes are longer distance, longer travel time; Avoiding some ports, Increase costs; Increase transport price, Arbitrariness of piracy

Luft [19] stated that piracy is especially dangerous for energy markets. Most of world’s oil and gas is shipped through the dangerous piracy-prone regions. Targets of piracy attacks include most classes of vessels. According to Berkeley [20], only the most expensive or well-equipped shipping companies will find it economically feasible to bring imports into piracy-prone waters. As a result, due to the possible arbitrariness of pirates, the following effects can mention: Increased competition energy markets; increase world’s oil price; increase general price levels; change in level playing field; specialization.

Doing business in a riskier environment could lead to higher investment risk premiums. Furthermore, crew impact of piracy can be enormous. Attacks, hostages, injuries, risk of being killed and traumas will lead to possible claims for damages by members of the crew and their relatives. Working in such environment will be less pleasant and can lead to a smaller labour market for the shipping industry. Modern pirates are taking advantage of the small size of the crew on modern cargo vessels. Shipping companies have to re-think about the size of their crew. Possible effects are: Increasing investment risk premiums; Crew impact; Claims of crew and family, smaller labour pool, less quality maritime transport service, increased workload on board, doublepay danger money; increase transport price [21].

Liability Maritime Transport

Pirate attacks against vessels can be used as a political tool to disrupt vessel passage through certain maritime bottlenecks [22]. This is especially true in the case of the strategically important Malacca Straits where most Middle East oil exports to Asia and most commerce between Asia and Europe pass. Due to fear of bottlenecks and changing steaming routes, it will lower the liability of maritime transport. It could create the need to count with higher inventory levels due to the potential piracy to cause bottlenecks in world’s delivery systems. This will reduce the benefits of just-in-time manufacturing processes and undermining supply chain management.

Effects are summed up below:

• Lower liability maritime transport.

• Costs of higher inventory levels

• Less (grow) of demand maritime transport.

Environmental impact of piracy

Piracy could lead to environmental disasters with oil tankers. There are known cases where the bridge left unmanned after an attack. Collision with another vessel or grounding could lead to environmental disasters. The costs of these kinds of disasters can be considered as tremendous. Effects are: Environmental and ecological catastrophe as well as major chokepoint closed for a long period of time.

The Resource Dependency Theory

This research is based on the resource dependency theory. Resource dependency theory has its origins in open system theory as such organizations have varying degrees of dependence on the external environment, particularly for the resources they require to operate [23]. This therefore poses a challenge of organization facing uncertainty in resource acquisition [24] and raises the issue of firm’s dependency on the environment for critical resources [25]. The external control of these resources may decrease managerial discretion frequently, interfere with the accomplishment of organizational objective, and eventually intimidate the existence of the focal organization. Confronted with the costly situation of this nature, management aggressively directs the organization to manage the external reliance to its advantage. Organization success is defined as organizations maximizing their power [24].

Nigeria economy mainly depends on oil and gas revenue especially as most of these resources are deposited in her ocean bed. Hence its exploitation and exploration depend to a large extent on the activities of the Nigeria Maritime sector. The external environment (piracy and armed robbery) therefore affects the activities of the maritime sector (revenue) to a great extent. The political, environmental, social, and technological factors on the external environment hence affect the activities and performance of the maritime industry as it is resource based. Therefore, the activity of the pirates which is a social factor affects the operation and performance of the maritime industry as poor performance will likely result during the period of high piracy activities. Controlling the social factor (piracy attack) of the external environment therefore will impact positively on the maritime sector (revenue generation).

The Weakness of the Failed States Theory

It is imperative to associate politics to crime, this is to have a clear understanding of reasons for maritime violent behavior. The Failed State Theory (FST) was advanced by Weber. He defined a failed state as a political body that has disintegrated to a point where basic conditions and responsibilities of a sovereign government no longer function properly.

Similarly, if a state weakens as well as average of living declines, it brings the likelihood of government fail meaning that, the state has been brought ineffective hence unable to enforce its laws uniformly and make provisions for fundamental goods and services to her citizens due to issues not limited to high crime rates, acute corruption in the polity, poor bureaucracy, ineffective judiciary as well as military interference in politics. Some of the characteristics of a failed state include 1) Partial or total loss of control of her territory or of the monopoly of legitimate use of physical force therein, 2) Attrition of rightful authority to make collective decisions, 3) Incapability of making provision of public services and, 4) Inability or poor interaction with other states as a full member of the international community. According to Monteclos [22], he insisted that failed states ease piracy which diminishes the authority of the state.

In his opinion, the correlation between piracy and state control is multifarious. African countries especially in Nigeria, the failed state theory can easily be seen in incessant attacks by pirate in the maritime domain. The criticism in colonial legacy of Nigeria has been attributed to the weakness of the Nigerian state. The Biafran War period 1967-1970 also may have contributed to this, also last decade of the Movement for the Emancipation of the Niger Delta (MEND), made demands for resource control of the Niger Delta resources. This gave rise to many groups in the area demand for rather their inheritable portion of the “national cake” without contest to the authority of the State.

Furthermore, Jones [26] stated that the Nigerian Government’s role as regard to piracy in Nigerian waters is confusing; according to him officials of the government conspire with the pirates and militant groups to really weaken the authority of the State. Security forces (police, Navy, Army) attack the militants and partake in illegal oil trading, piracy and kidnappings which is the core under-current factor befalling the Nigerian economy as currently palpable corruption in our faces.

Most governors of the oil-producing states also to get rid of opponents, fund their unlawful activities, yet also fund the leading political parties, Monteclos [22] also asserted that “the Nigerian State herself is associated in maritime piracy as analysis of government agencies made some revelations in this regard. According to him the army, concludes in the shade deals with the militants to divide up the booty and bargain a status quo”. The Nigerian Navy on the same hand is corrupt and caught up in illegal drug and oil trading behavior. The weakness of state theory explains why the officials of Navy, Army, Customs, and Port Authorities of today still update pirates and militants in the places the where about of boats and the real values of their cargo, this has contributed to inability of winning the war against maritime piracy both in Nigeria and Gulf of Guinea over the years.

Methodology

Method of data collection

The data for this study was sourced through the secondary means. Data were collected through several publications, textbooks, International Maritime Organisation. Seminar papers and Nigerian Maritime Administration and Safety Agency (NIMASA) annual bulletins and International Maritime Bureau (IMB), etc.

Research Design

Research design provides the glue that holds the research project together. Ex-post facto research design was therefore used for this study.

Analytical Method used

The simple regression analysis was used to model the relationship between the dependent and independent variables in the research hypothesis. Hypothesis one is on cost of ransom and the premium paid by the shipping company. Cost of ransom is a proxy for the activities of piracy and premium paid affects the revenue generated by the company, hence, the model for the relationship is

MAREV= f(PIRACY) (1)

Y = Bo +B1X1 + u

Where:

Y = Maritime revenue

Bo = Constant

X1 = Piracy incident

U= error term

The second model is on sea piracy and Nigeria’s economic growth. The model for this hypothesis is

GDP= f(PIRACY) (2)

Y = Bo +B1X1 + u

Y= GDP proxy for economic growth

X1= piracy incidents

U= error term

Presentation and Analyses of Data

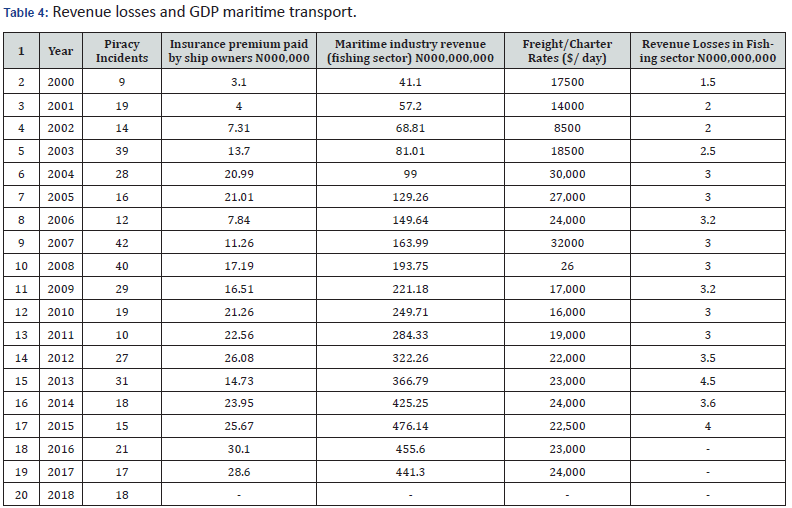

The data as obtained from the Nigerian Maritime Security agency (Table 4)

Time series statistical data on piracy and armed robbery attacks against ships in Nigeria, associated insurance costs/ premium paid by shippers and ship owners, piracy induced revenue losses by industrial fishing sector and GDP maritime transport.

Analysis of Data and test of hypotheses

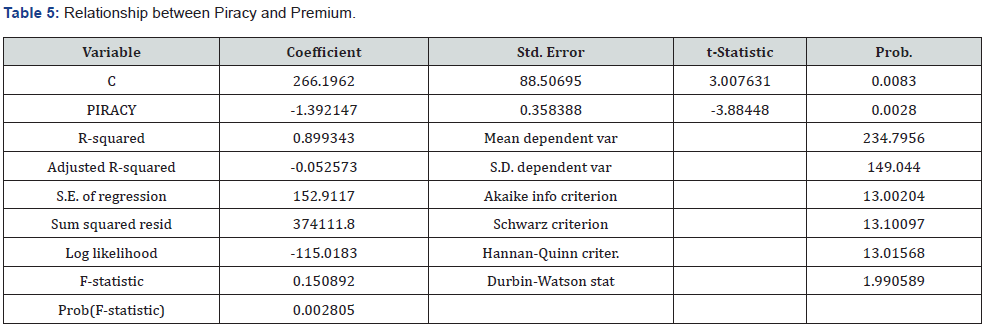

Hypothesis One (HO1): There is no significant relationship between the cost of ransom and Premium paid by shipping companies.

Dependent Variable: MAREV

Method: Least Squares

Date: 03/01/20 Time: 13:12

Sample (adjusted): 2000 2017

Included observations: 18 after adjustments (Table 5)

Source: IMB Piracy and Armed Robbery Reports Against Ships (2004, 2007, 2011, 2015 and 2019 editions). Central Bank of Nigeria Statistical Bulletin (2010, 2013 and 2019 editions). Marine insurance Digest, (2007, 2012 and 2019 editions). Nigerian Industrial Trawler Owners Association (NITOA)

The output above shows that there is a negative relationship between piracy and premium paid by the shipping company. This implies that as piracy activities increase, the company pays more ransom, and this leads to fall in maritime revenue. The coefficient of determination is high and shows that the model explains about 89.9% of the total variation in the model. The overall regression is significant as the p-value is less the 5% level of significance.

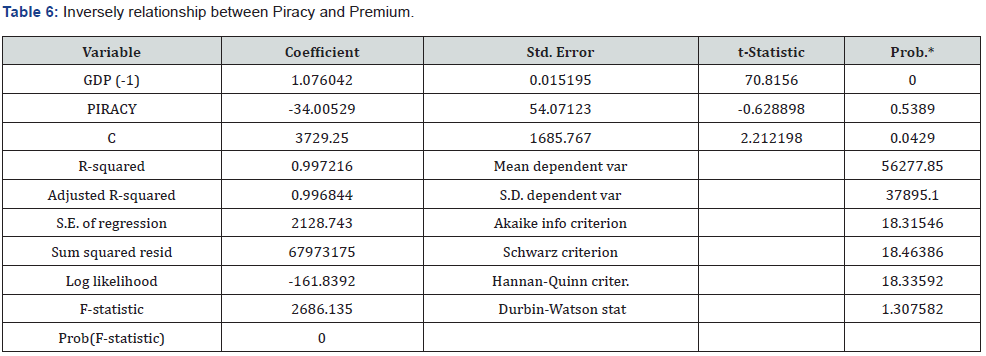

Hypothesis two (HO4): There is no significant relationship between sea piracy and Nigeria’s economic growth?

Dependent Variable: GDP

Method: ARDL

Date: 03/01/20 Time: 13:13

Sample (adjusted): 2001 2018

Included observations: 18 after adjustments

Maximum dependent lags: 4 (Automatic selection)

Model selection method: Akaike info criterion (AIC)

Dynamic regressors (4 lags, automatic): PIRACY

Fixed regressors: C

Number of models evaluated: 20

Selected Model: ARDL (1, 0)

Note: final equation sample is larger than selection sample (Table 6)

The model shows that piracy inversely relates with economic growth. The model is rightly signed and significant. The overall regression is significant, and the coefficient of determination explains about 99.7% of the variation in the model.

Discussion of Results

From the hypothesis one, there is no significant relationship between the cost of ransom and Premium paid by shipping companies. The output showed that there is a negative relationship between piracy and premium paid by the shipping company. This implies that as piracy activities increase, the company pays more ransom, and this leads to fall in maritime revenue. From the review of various literatures and analyses of the data, it was observed that piracy incidents and activities adversely affect revenue of the maritime industry as well as the nation’s economic growth. It increases the cost of security through increasing insurance premiums. It leads to drop in revenue and scares foreign investors. It also increases the costs of imported goods. This is in line with Berkeley (2005), who opined that only the most expensive or wellequipped shipping companies will find it economically feasible to bring imports into piracy-prone waters

The second hypothesis which depicts that piracy inversely relates with economic growth. The above output indicates that piracy is positively related with economic growth. The increase in the activities of the pirates will for force the company and ship users to increase the cost of insurance of the cargoes and vessels. The model is rightly signed and significant. It is in line with Munich Re Group [17], it is far more difficult for the insurers to reduce the incurred loss then for their clients, if the insurance companies getting aware of a new increase of piracy in some dangerous waters, then it is a fact that the insurance premiums will rise, which certainly affects the output of maritime transport and directly affecting the economic growth of Nigeria [27-28].

Conclusion

The traumatic effect on the shipper (cargo owner) carrier (ship owner) the insurers and the crew/passengers on board the subject matter embarking on the voyage. Also, the position of Nigeria in the maritime prone areas statistical data as obtained from the annual piracy report /publication from the international organizations was also featured. The proactive suppression of these armed attacks is not only the responsibility of the international shipping industry out of the terminal operators, port authorities, and industry but of the terminal operator’s ports authorities, coast guards and relevant local, regional, and national government or coastal states. Such bodies face many problems not least the growing sophistically of organized criminals, but only by their commitment and co-operation can the growing problem of armed attacks on ship be contained. From the findings, political instability in the country and around the coast guards has been seen as a major contributory factor since most of the piracy incidents with the growing importance of maritime trade in the nation’s development need not to be jeopardized on the ground of grievance of political marginalization.

Recommendation

In the light of the findings of this study, the following recommendations are made

• There should be regional cooperation and international cooperation among trading nations and coastal areas.

• There should be production of knowledge products for security measures.

• There should be contributory financial resources scheme for fighting piracy and improvements in port security.

• Anti-piracy laws should be enacted to seal with sea pirates’ development of piracy.

Vessels should be instructed not to anchor in high-risk areas.

Comments

Post a Comment